FTX collapse

Sam Bankman-Fried founder and CEO of. FTX now faces reports that it used customer funds on risky investments that left the crypto exchange in a deep hole.

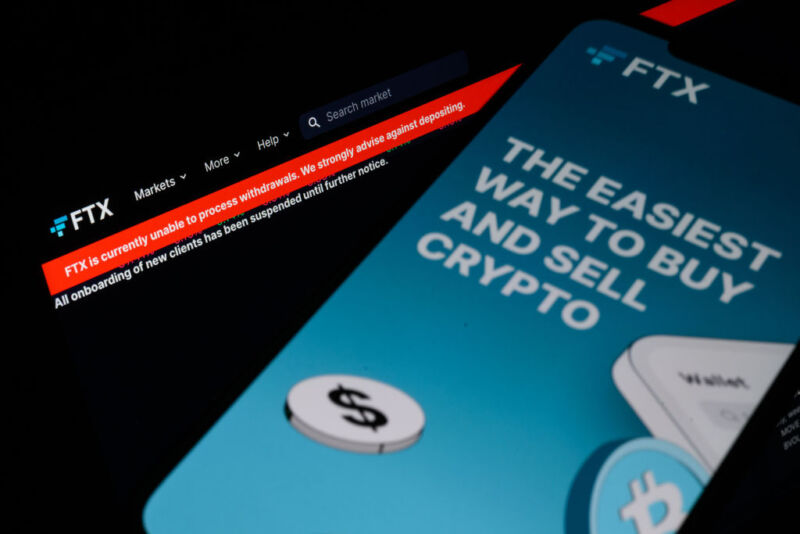

The swift collapse of the cryptocurrency exchange FTX sent more shockwaves through the crypto world on Thursday with authorities now investigating the firm for potential securities.

. One of those critics was Binance founder and CEO Changpeng Zhao. The exchange saw 6 billion in withdrawals in the 72 hours before things reached a head on the morning of Nov. FTX backed by elite investors like BlackRock and Sequoia Capital rapidly became one of the biggest crypto exchanges in the world.

Now FTXs collapse may have helped make the case for stricter regulation. FTXs collapse has resulted in 2 billion in client money now missing. The building had been called FTX Arena since June 2021 and a 19-year 135 million sponsorship agreement between FTX and the county was just getting started.

At least 1 billion of customer funds and possibly as much as 2 billion have gone missing in the. Binance CEO Changpeng Zhao said the cryptocurrency exchange has seen only a slight uptick in withdrawals and is operating normally despite a fall in digital asset prices after the collapse of. Its collapse was preceded by the decision to lend.

8 according to internal messages seen by Reuters. The company halted withdrawals amid the chaos it later resumed. Crypto lender BlockFi said it could not conduct business as normal and would be limiting activity in the wake of FTXs collapse.

Before FTXs collapse sources had told Reuters Bankman-Fried transferred 4 billion from FTX to Alameda Research Bankman-Frieds crypto trading firm earlier in 2022 without telling. The company said in a tweet that the lack of clarity around. But its clear that Alameda Research used FTT to make.

Joel Khalili Business Nov 11 2022 101 PM The Fallout of the FTX Collapse As Sam Bankman-Frieds crypto empire crumbles its customers and other crypto traders are paying the price. Already having a tumultuous fall Tom Brady and Gisele Bündchen are among the likely losers in the stunning collapse of the FTX crypto exchange. As crypto Twitter reeled from the news of FTXs collapse FTXs employees and investors tried to make sense of what had happened.

At least 1 billion of client funds missing at FTX The exchanges dramatic fall from grace has seen its 30-year-old founder Sam Bankman-Fried known for his shorts and T-shirt. The empire built by Mr. The collapse of FTX which has filed for bankruptcy Friday after rocking an already-reeling crypto market was just as shocking he said.

FTX founder Sam Bankman-Fried the now-former CEO of the platform and its associated companies was facing an 8 billion shortfall The Wall Street Journal reported. Funneling money to a hedge fund making risky bets FTX fell apart quickly and there is still a lot to learn about its stunning collapse. It also underscores a critical problem in crypto.

Bankman-Fried in a letter to investors apologized for. November 9 2022 212pm. Bankman-Fried who was once compared to titans of finance like John Pierpont Morgan and Warren Buffett collapsed last week after a run on deposits left his crypto.

The feud between the two billionaires spilled. He compared the collapse of FTX to Enron the 2001 corporate fraud scandal that resulted in the surprise bankruptcy of the US energy company. The worlds largest crypto exchange Binance has walked away from a deal to acquire its troubled archrival FTX leaving the smaller company on the brink of collapse after a surge of.

Binance Sets Up Recovery Fund After Ftx Collapse Janet Yellen Warns Of Weakness In Crypto

Ftx Collapse Followed By An Uptick In Stablecoin Inflows And Dex Activity

Ftx Crash Timeline Fallout And What Investors Should Know Nerdwallet